IDC and Cisco confirmed this week that Cisco has taken the #1 x86 blade server spot in North America for Q1 in 2014 with 40% revenue market share according to a recent CRN report. This is quite an accomplishment especially since Cisco has only been reporting their numbers for 3 years. So you might wonder – what is the secret to Cisco’s success? I have a few ideas (right or wrong) that might shed some light on why Cisco is having success in their blade server business.

Category Archives: Market Analysis

IDC Reports Increased Blade Server Growth in Q1 2014

The quarterly IDC Worldwide Server Tracker was released on May 28, 2014 and it reported that in spite of a decrease in overall server sales, blade servers continue to increase with HP leading the way. To save you the task of reading all of the irrelevant server data, here’s a summary of their blade server findings:

Blade Servers Preferred Over Rack Servers (Based on Q3 2013 Report by TBR)

In October, Technology Business Research (TBR) released a report titled, “Corporate IT Buying Behavior & Customer Satisfaction Study x86-based Servers” in which they discussed several topics around customer satisfaction such as Sales and Setup, Server Hardware and Service and Support. Although the report (linked below) is 109 pages, below are a couple of key topics which I found interesting.

IDC Reports Worldwide Server Market Revenues Declines -3.7% Q3 2013

IDC came out with their Q3 2013 worldwide server market revenue report on December 4, 2013 which shows blade server revenues grew 7.7% $2.3 billion. This was a huge turnaround from the -6.2% loss as reported last quarter. Blade server sales accounting for 18.7% of all server revenues reported, nearly 2% higher than last quarter. According to IDC, demand for x86 servers continued to improve in 3Q13, with revenues growing 2.8% in the quarter to $9.5 billion worldwide with unit shipment growth flat at 2.2 million servers. Continue reading

Revenue or Units Shipped? What Should Shares Be Measured With?

A recent CRN article showed that Dell has gained significant shares the server space over HP and IBM, however an IDC representative states that units shipped do not represent accurate market share, and I disagree.

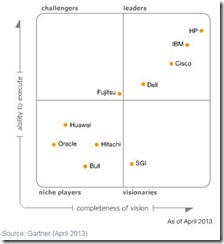

Gartner Blade Server Quadrant (April 2013)

Gartner released the annual Magic Quadrant for blade servers last month and it shows significant changes across the leaderboard within the top 4 leading blade server vendors.

The Magic Quadrant is a tool Gartner uses to visually define a given market segment showcasing technology vendors who are leading the market in 4 areas:

Is it Time to Rethink Your Position On Blade Servers?

Is it time to rethink your position on blade servers? A recent vendor neutral article from Processor.com thinks it is. The October 5th edition of Processor magazine provided an article titled, “Rethink Your Position On Blade Servers” where they offer reasons to look at blade servers in your environment. Continue reading

Q3 2011 IDC Worldwide – Steady as She Goes

Hot off the presses is the latest IDC worldwide server market revenue report for Q3 2011. The gist of the report is that while some of the numbers are slightly adjusted, really not much has changed in the blade server market.

Revenue growth for the entire server market (all servers, not just blade servers) slowed considerably showing only 4.2% year over year growth bringing in $12.7 billion. Growth in the world of servers continues but this marks the slowest growth rate for any quarter since Q1 2010. IDC believes that overall server sales will continue to decelerate due to weakening economic conditions around the globe. “After nearly two years of steady revenue growth, the server market began to decelerate in Q3 2011 as demand stabilized for many system categories,” said Matt Eastwood, group VP and general manager. Incidentally, IBM and HP are both holding steady, tied for the #1 spot in revenue share, at 29.8%.

When looking at the blade server market specifically, growth was steady for Q3 2011 but not as explosive as Q2 2011. IDC reports “solid growth” in the quarter with a revenue increase of 16.4% year over year (vs 26.9% growth in 2Q11). Shipments increased 2.4% (vs 6.2% reported growth for 2Q11). One thing that hasn’t changed since last quarter is that 89% of all blade revenue is driven by x86 systems. Also, blade server sales representing 20.8% of all x86 server revenue. This shows continued steady growth for the blade server segment but that the pace may be slowing slightly.

#1 market share: HP managed to hold the majority margin moving to 51.0% in Q3 2011 from 51.9% in Q2 2011.

#2 market share: IBM continues to see its margin chipped away slightly down to 18.5% in Q3 2011 from 19.1% in Q2 2011.

#3 market share: Cisco’s disruptive market penetration seems to have slowed at 10.7% overall compared to a solid 10% in Q2 2011.

#4 market share: Even Dell dropped slightly to 7.2% revenue share from 8.2% last quarter.

In looking at the totals, the top four vendors represented 87.4% of the revenue share in the blade servers market which is actually down 2% from last quarter. Cisco grew revenue share by less than 1% which means that some of the displacement of the remaining top vendors is not accounted for. Does this mean there may be some new players in the “others” category that we should be watching? Without a detailed breakdown it’s hard to tell but I’ll definitely be looking forward to comparing the numbers next quarter to see if the trend continues. It could, after all, just be a factor of the margin of error in the statistics.

According to Jed Scaramella, research manager, Enterprise Servers at IDC, “Blade systems represented the fastest growing segment in the server industry and now account for 16.0% of total server revenue – a historic high.”

Probably the most interesting aspect of the report is the introduction of hyper-scale servers. “Hyper-scale servers are designed for large scale datacenters with streamlined system designs that focus on performance, energy efficiency, and density.” This sounds like the mantra for blade servers with the main difference being the lack of management and high availability capabilities at the hardware level. Basically these represent the miles of simple, rack mount commodity servers used by the likes of Google and Facebook. This is a $428 million dollar server segment and growing.

For the full IDC report covering the Q2 2011 Worldwide Server Market, please visit IDC’s website at http://www.idc.com.

Q2 2011 IDC Worldwide Shows Continued Blade Server Growth

IDC came out with their 2Q 2011 worldwide server market revenue report on Aug. 23, 2011 which shows that IBM may be poised to take over the #1 spot within the next few quarters. Continue reading

Cisco Finally Releases UCS Market Share Numbers

May 24, 2011 – IDC came out with their 1Q 2011 worldwide server market revenue report today showing that Cisco has finally entered the market standings with a 3rd place standing at 9.4% factory revenue share . IDC’s findings also showed that both HP and IBM decreased their blade server market share from Q4 2010. Continue reading